Working with GrowthZone Pay

Contents

Integrated Payment Processing Overview

Accept payments using MicroNet’s Integrated Payment Processing. Members can securely store their account information to conveniently pay for events or futures invoices. In addition, recurring charges may be setup to make sure membership dues are automatically collected.

Due to the tight integration with your database, there is no need to log into a separate portal to view successes or failures, perform refunds or view statements from your processor. It’s all included within your Integrated Billing screens – even providing a virtual terminal for running single direct charges.

Features include:

- Automatic recurring credit/debit card charges so you are sure to get your payments

- Safe storage of payment card info for convenient event registration and member payments

- Automatic matching of credit card payments with invoices, saving hours of labor

- Automatic bank draft (ACH) option available and included with setup (US customers only)

- Online, real-time statements and bank deposit/transfer reports

- Virtual terminal included for running single direct charges

- Convenience – one management location, integrated with billing, simple

- Inclusive pricing – all features, integrated, single point of support – one simple rate!

Initial Set Up

![]() This video walks you through the step-by-step process (outlined below) of getting set up with Integrated Payment Processing.

This video walks you through the step-by-step process (outlined below) of getting set up with Integrated Payment Processing.

Entering Your Information

1. After your account has been enabled by customer support, log into the back office with administrative permissions and go to Setup ➝ Billing Options & Settings ➝ Credit Cards section.

2. Click the Account Setup button.

3. When the "Setup - Integrated Payment Processing" screen appears, select your country and click the "Sign up" button. MicroNet and Stripe's terms and conditions can be viewed on this page (these terms and conditions can also be viewed in the Billing Setup page at any time).

4. Complete the form, clicking the info link to get more information about a field. You can add more than one bank account, but only one can be set as active.

5. Click Save. Once submitted, this information is reviewed by Stripe, the company we partner with to bring you Integrated Payment Processing.

6. While still in the Credit Card section of the Billing Options & Settings page, verify the settings are configured the way you would like them and click Save.

7. Click Billing ➝ Reports ➝ Payment Processing Reports / Management Tools in the "Banking" section.

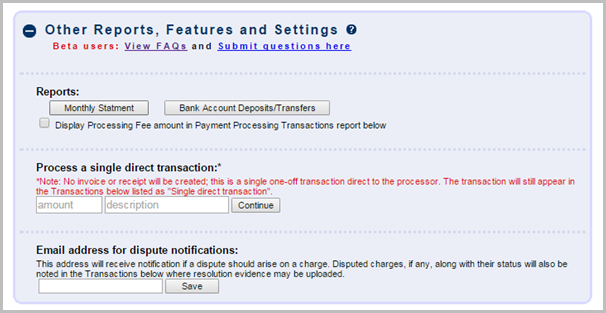

8. Open the Other Reports, Features and Settings section.

9. Enter a valid email address in the "Email address for dispute transactions" section.

Running a Test

1. While still in the Other Reports, Features & Settings, locate the Process a single direct transaction section, enter an amount of at least $0.50, enter a description to help you identify this transaction on your bank account and click Continue.

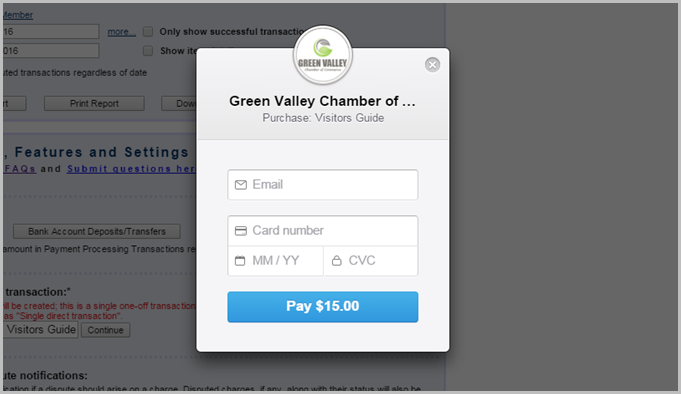

2. A pop-up screen should appear with a form to enter your email address and credit card information. Enter the information of a valid credit card to charge this live transaction to, then click the Pay button.

3. Once you click the Pay button, you will see the transaction in the Payment Card Transactions report at the bottom of the screen, as well as on the Monthly Statement. You will also see this transaction in the Bank Account Deposits/Transfer report after two business days.

4. Your account is live and ready to process transactions!

Member Payment Options

Once your account has been set up and you have run a test transaction, members will be able to pay their bills when logged into the MIC with appropriate permissions. They can pay by credit card or with a checking or savings account.[1]

Paying with a Credit Card

![]() This video shows how members can pay for an event using a stored credit card.

This video shows how members can pay for an event using a stored credit card.

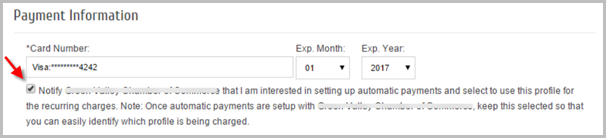

During the checkout process, when paying for an event or invoice, members will have the option to save a credit card for future transactions by clicking the Securely Save this Card checkbox. If a member would like to add a card as a payment profile without making a payment, they simply need to add a payment profile in the MIC by going to Account Settings ➝ Billing ➝ Payment Profile. Note: Storing and using payment profiles is only available to fully authenticated users, (ie, the user must enter their login and password).

Paying with a Bank Account

![]() This video shows how members store a bank account, verify and then use later.

This video shows how members store a bank account, verify and then use later.

Members who would like to pay for one-time or recurring transactions with a bank account (U.S. banks only) must first set the account up as a Payment Profile in the MIC and then have it be verified.

Setting up a bank account as a Payment Profile

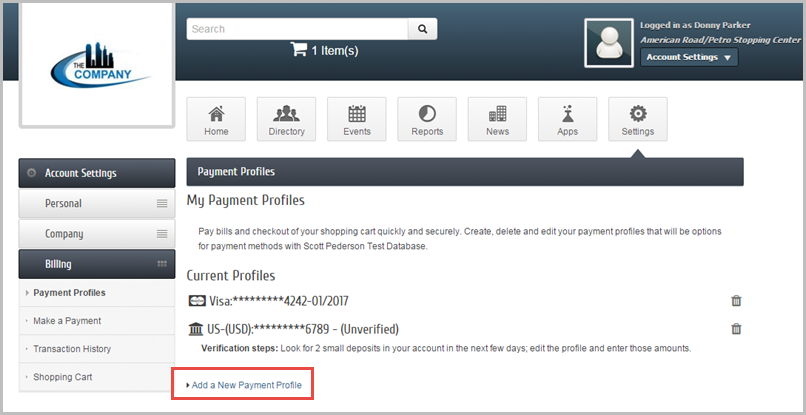

1. Log in to the Member Information Center with admin or billing permissions.

2. Click Account Settings ➝ Billing in the upper right part of the screen.

3. On the left menu under Billing, click Payment Profiles.

4. Click Add a New Payment Profile.

5. Under Payment Information, select the Bank Account option.

6. Complete the form with all the required fields.

7. Click the Add Profile button.

8. Before the bank account can be used to make a payment, it must be verified. Look for two small deposits in your account in the next couple of days; edit the profile and enter those amounts.

Setup Recurring Charges

1. Request authorization from your members to implement automatic payments on their behalf and encourage them to enter their credit card or bank account (US banks only) into the Member Information Center.

Tip: We’ve created an email template as a suggestion and starting point. Open the email template “Automatic Monthly Payment Invitation”, modify with any desired changes and send to your members.

|

| Note: Members have an option to notify you once they’ve entered their Payment Profile and would like to setup automatic payments. This will send an email to the address listed under Setup ➝ Billing Options and Settings under Credit Cards section. If no email is selected here, the email under Setup ➝ Association Information will be notified. |

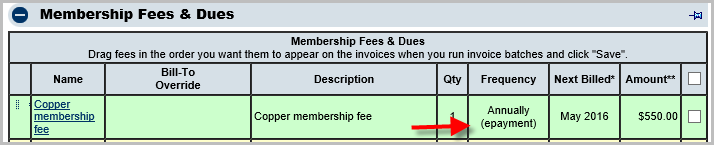

2. Assign or modify the members' Membership Fees and Dues and associate them with the correct Payment Profile.

| Note: After saving, the Frequency column will then display (epayment). |

3. Follow-up with the member by sending them a confirmation.

Tip: We’ve created an email template as a suggestion and starting point. Open the email template “Automatic Payment Confirmation”, modify with any desired changes and send to your members.

|

4. To charge the cards and/or bank accounts, run your monthly epayment batch. View FAQs on epayment batches and profiles

Manage and View Transactions

![]() This video shows where to view and manage your transactions.

This video shows where to view and manage your transactions.

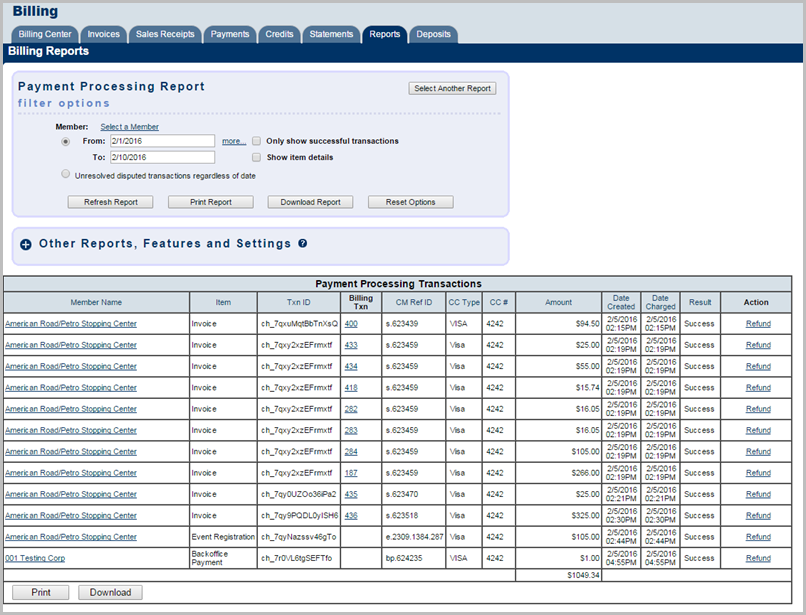

All transactions, refund options, processing fees, statements, and reports can be viewed under Billing ➝ Reports tab. Select Payment Processing Reports / Management Tools.

The Payment Processing Reports / Management Tools section

Running a Single Direct Transaction

There may be situations when you need to run a transaction for a one-time charge without an invoice or sales receipt. These transactions will not show up in your Integrated Billing reports. It only appears on the Payment Processing Report.

1. Go to Billing ➝ Reports ➝ Payment Processing Reports / Management Tools ➝ Other Reports, Features and Settings.

The Other Reports, Features and Settings section

2. In the Process a single direct transaction section, enter an amount, a description and click Continue.

3. When the popup window appears, enter the customer's email address and credit card information, then click Pay.

Mobile Card Reader Options

Coming 8/15/2016...

Description

Save time and receive additional convenience by connecting the mobile card reader to your Android or iOS device, login to the staff app and receive event registration payment at the door by swiping the attendees' credit/debit card; automatic invoice and payment (or sales receipt) transaction is immediately created in your database.

Benefits

- Event registration payment using the mobile card reader immediately updates the back office with the billing transaction – no manual matching of payments later

- Payment receipt emailed immediately after submitting payment info

- No surcharge for mobile payment processing; same single, simple rate no matter where/how you process the card

- Using the staff app also gives easy access to the attendee check-in feature.

Requirements

- Use our Integrated Payment Processing as your credit card solution

- Download or update to the newest version of the ChamberMaster or MemberZone Staff app

- Upgrade the Staff app to the Premium edition

- Ensure your Android or iOS device is supported by the card reader.

- Supported Android list

- Note: All Apple iOS devices are supported.

- Purchase the Shuttle mobile card reader from the recommended distributor.

- Contact support for the current promo code to receive a discounted rate and free shipping.

How to Use

- Plug in the card reader into the audio jack on your device.

- Open the app and navigate to an event where payment should be taken.

- Click to View Attendees.

- Tap the Money symbol next to the name of the attendee who is paying.

- Tap the Pay with Card button. The screen will say Ready for Swipe.

- Swipe the card. The screen will say Card Read Successfully.

- Click Submit Payment Now.

Tips:

|

FAQs

General

Q: What software edition do I need to have?

A: Plus, Premier or Pro edition is required at this time. Other editions may eventually be supported.

Q: Can I use MicroNet’s integrated payment card processing if I have the legacy QuickBooks CQI integration?A: No, not at this time.

Q: What country can I be from (my legal entity) in order to set this up?A: United States, Canada, Ireland, United Kingdom and Australia.

Q: Do I need to be using the updated event registration?A: Yes. The integrated payment card solution is only available with the updated shopping cart, which is only part of the updated event registration. This updated event version is available at no charge to all customers and provides lots of great new features. Check whether you are on the newer version by going under Setup->Event Options and Settings and under Registration and Billing Preferences. Ensure the check mark is enabled in front of Enable updated event registration and Guest List.

Q: If using the ACH and bank account storage feature, what countries are supported for where the bank account can be located?

A: United States banks only.

Q: What currency types are supported for the amounts that will be charged to their cards?A: US dollar, Canadian dollar, Euro, English pound, and Australian dollar. You will select your default currency type that will be used on all transactions on the Account Setup screen.

Q: What international support is available for bank locations and supported currency.A: International customers may choose their desired currency: US dollar, Canadian dollar, Euro, British pound or Australian dollar (only one supported per database). Your bank account where automatic deposits/transfers are made may be located in the US, Canada, Ireland, United Kingdom or Australia. The same transaction rates and fees apply as above with no additional charges.

Q: What payment card types are accepted?A: Both debit and credit cards are accepted. U.S. businesses can accept Visa, MasterCard, American Express, JCB, Discover, and Diners Club. Canadian, Australian and European customers can accept Visa, MasterCard, and American Express. You can also accept gift and prepaid cards that are one of the above types.

Setup Questions

Q: What are the steps involved to get started after my database is enabled with Integrated Payment Processing?

A: Three easy steps are required to start accepting payments Watch this video for a 3 min demo

http://www.screencast.com/t/PujiGx9Z

http://www.screencast.com/t/PujiGx9Z

- 1. Login to your database and complete the Account Setup screen.

- 2. Modify any credit card settings if needed.

- 3. Run a quick test.

Q: How long does it take to get setup? Can I process credit card transactions immediately?A: Yes. You can receive charges into your bank account immediately for up to ~$2,000 after simply submitting the form with the minimum required fields completed. However, if Stripe needs more information to complete verification process, transfers of money beyond ~$2K into your bank account will be suspended until after your account has been fully verified.

Q: Will I be notified when my account is verified?A: Yes, an email will come to the email address entered when you filled out your Account Setup information. If no email address was entered there, then the email address listed under Billing ➝ Reports ➝ Payment Processing Reports ➝ Other Reports, Features and Settings will be used or lastly the email address under Setup ➝ Association Information. You can also check your status under Setup ➝ Billing Options and Setting in the Credit Card section. Details Verified will change to "True" once you've been verified.

Q: Where do I enter my verification information?A: Under Setup ➝ Billing Options and Setting in the Credit Card section. Click Account Setup.

Q: Are there any businesses, business activities or business practices that I may not accept payment from?A: Yes. As part of your agreement with Stripe and MicroNet, you agreed to never accept payments in connection with the businesses, business activities or business practices listed here.

Q: What types of card holder verification is supported?A: CVV and address verification.

Q: Can I have more than one bank account where the transfers are deposited?A: Although you can have more than one bank account listed in the Account Setup, only one of those can be active at a time. Indicate which bank account is active by selecting the default account for your currency type when editing the bank account information under Setup ➝ Billing Options and Settings in the Credit Card section.

Q: Does this solution replace both my merchant account and gateway?A: Our solution replaces the need for any other merchant account or gateway for receiving payments into your database by doing all the tasks necessary for a complete transaction - accepting the payment data and depositing the funds into your bank account. All transactions that are performed in the database are handled by our one single solution.

Q: Why do I need to agree to Stripe's terms of agreement when signing up?A: MicroNet has implemented the integrated payment card processing using an API provided by Stripe. As part of our agreement with Stripe in using their API, our customers (you) need to agree to both our terms of agreement for the integrated credit card processing and Stripes agreement. In the agreement you are considered the Connected Account and MicroNet is the Connect Platform.

Q: Who is Stripe?A: Stripe started in 2009 and is now considered an elite startup company after striking a deal with Apple and Twitter in Sept 2014.* Stripe stands out from rivals for the amount and ease of code it offers, which lets software programmers quickly incorporate the payment features into their apps. They are based in San Francisco with worldwide offices. It is currently implemented in checkout carts of Twitter, Kickstarter, Shopify, Salesforce, Lyft and others.

Q: Is Stripe PCI compliant?A: Yes. See their information listed here.

Q: What type of security do you have in place?

A: Security is of supreme importance in our implementation and in who we partner with, which is one of the reasons we partnered with Stripe, Inc.

MicroNet does not store, process and/or transmit cardholder data. MicroNet has implemented the integrated payment card processing using an API provided by Stripe which provides a method for securely sending sensitive information to Stripe directly from the customer’s browser. Collection, storage and processing of all cardholder data is all handled by Stripe, Inc.

Security measures provided by both MicroNet and by Stripe meet and maintain the high standards required by PCI-DSS security compliance. MicroNet conducts and passes monthly PCI compliance scans to ensure we remain in compliance on areas that apply to us. Stripe has been audited by a PCI certified auditor, and is certified to PCI Service Provider Level 1 https://support.stripe.com/questions/is-stripe-pci-compliant, the most stringent level of certification available. Stripe is also a participant in the PCI Security Standards Council. See Stripe’s website for their answer to their security compliance. https://support.stripe.com/questions/what-kind-of-security-does-stripe-have-in-place

Q: Do I need to create my own cyber security policy?

A: Your organization’s risk and responsibility in regards to the implementation within Micronet’s software is minimal due to the security methods in place by both MicroNet and Stripe however, we never discourage an organization from creating and maintaining their own information and cyber security policy as vulnerabilities and threats are constantly evolving and the future, of course, is always unknown. But legally speaking, nothing is required on your end.

Switching from Another Processor

Q: Do you have a video I can watch to explain the things I need to consider before switching?

A: Yes.

This video shows how to determine if you have anything special to consider before switching and explains the FAQs in this section.

This video shows how to determine if you have anything special to consider before switching and explains the FAQs in this section.

Q: What if I want to switch to Integrated Payment Processing but I have automatic billing setup with a 3rd party processor and have manual epayments assigned to my members which automatically create my transactions for me each month when I run my monthly epayment batch?A: No problem. There are two ways to approach the transition to Integrated Payment Processing for automatic recurring billing that is currently done outside of the database with a 3rd party processor.

- 1) Gradual: Continue using your 3rd party processor for the recurring billing. Whenever a member successfully enters their account info as a new payment profile in the Member Information Center (MIC), change their fee assignment from Manual epayment to the Automatic epayment associated with their newly entered profile. When running your monthly epayments batch, it will include both the manual epayments and automatic epayments in the same batch. Remember to disable the automatic billing in your 3rd party processor whenever you assign the member to the new automatic epayments.

- 2) Immediately: After the last 3rd party batch has been processed, stop using it for the recurring billing and do not use it for your next batch. Next, remove the manual epayment assignment from your member fees. (This means they would temporarily be included in the regular Monthly Renewals batch and would receive an invoice.) Once the member has successfully entered their account info as a new payment profile in the Member Information Center (MIC), you can enable the automatic epayment on the member fee. When at least one member is setup with an automatic epayment assignment, then you will need to begin running the monthly epayment batch.

Q: What if I want to switch to Integrated Payment Processing but I have automatic billing setup with Authorize.net and CIM with automatic epayments assigned to my members which automatically create my transactions and bill the customers each month when I run my monthly epayment batch?A: No problem but there are a few steps to do prior to switching over.

Switching over to Integrated Payment Processing means that all transactions within the database will be processed with this new processor. Consequently, the Authorize.net epayment profiles will no longer work if those profiles are processed with Integrated Payment Processing. And due to PCI compliance rules and other security concerns, these profiles may not be transferred from one processor to another – they must be re-entered. Here would be the steps we would recommend:

- (Optional) Let your members know that changes are coming and in the meantime they temporarily will not be able to pay invoices with stored cards/bank accounts while you clear out the old profiles and switch to the new Integrated Payment Processing.

- Run and keep a copy of the “ePayment Profile Report”, to view a list of members that have epayment profiles stored with Authorize.net.

- Run and keep a copy of the “ePayment Fee Assignment“ report to see those that are assigned for automatic payment with Authorize.net during your epayment batch.

- Remove the automatic epayment assignment from your member fees. (This means they would temporarily be included in the regular Monthly Renewals batch and would receive an invoice.) Note: Contact customer support to have this done globally for you.

- Delete the Authorize.net epayment profiles by impersonating the rep and deleting the profile. Note: contact customer support to have this done globally for you.

- Contact customer support or call 800-825-9171 option 4 (the fastest option) and switch to the new Integrated Payment Processing and complete the quick setup steps.

- Follow the steps for setting up recurring billing.

Q: My members have credit card and bank account stored with my 3rd party processor and I use their recurring billing with no transaction automatically created in the database (not using Manual epayments). Can I have these accounts transferred to Integrated Payment Processing or will my members have to re-enter them?A: They need to be re-entered. Due to PCI compliance rules and other security concerns, these profiles may not be transferred from one processor to another – they must be re-entered.

Q: If I switch to the Integrated Payment Processing, does Micronet contact my previous processor?A: No. Your account with your previous processor is your responsibility to close out or maintain. However you want to handle it.

Day to Day Operations

Q: What types of features are available to me?

A: Our Integrated Payment Card processing allows you to start accepting payment cards as payment for event registrations, on your membership application and for invoices in the Member Information Center. You can also setup features such as recurring payment card and bank account billing (US banks only). And your members now have the convenient option of storing their payment cards and/or bank account (US banks only) for convenience when paying online.

Q: Does Integrated Payment Card processing allow us to attach a swipe device?A: It will be available mid-August 2016. This is one of the reasons Stripe was chosen as their platform will allow us to further develop and seamlessly integrate this part of the solution. See the info on Mobile Card Reader.

Q: Is there a minimum purchase that can be made?A: Yes - 50 cents

Q: What is the maximum size for my Statement Descriptor?A: Yes, 22 characters. This is the phrase that will appear on your customers' credit/debit/bank statements.

Q: Will I know which staff person processed the single, direct transactions that do not create a billing transactions?A: Yes. Entries are recorded in the Setup ➝ System Event Log when any transaction is made to the Integrated Payment Card processor. The single, direct transactions specifically mention the name of the staff person who ran the transaction.

Q: Will I receive any emails when purchases are made?A: Yes. An email from the database will come to the email address listed under Setup ➝ Billing Options and Settings in the Credit Card section.

Q: The person who signed up for this account is no longer with the organization. How do I make sure to update this account with an updated contact name?A: Contact MicroNet support via email with the name of the contact that you’d like to have listed as the contact. An email verification will be sent back to you stating that this change has been made.

Q: How do I deactivate/close my account with Stripe and MicroNet?A: Contact MicroNet Customer Service who will deactivate your Stripe account.

Q: How do I issue a refund?A: Click the Refund link on the Payment Processing Report or on a fully applied payment. Then follow the steps for creating the appropriate bookkeeping entry.

Q: Are the fees returned to me when doing a full refund?A: Yes. When you refund a charge, the fees you paid to process the charge are returned to you. That is, after charging and then completely refunding a payment, the net cost is zero. If you partially refund a charge, the pro-rated portion of the percentage cost is returned but the fixed fee of .35 is not.

Q: How soon is money deposited (transferred) into my account?A: Your very first deposit may take up to 7 days to be deposited. After that, deposits (transfers) are made daily and are typically composed of the payments that were processed two days prior for most US and Australia customers; seven days for other countries. For example, August 1st charges are deposited by August 3rd for most US and Australia customers; August 8th for other countries. August 2nd charges are deposited by August 4th for most US and Australia customers; August 9th for other countries. On occasion, banks may take 2-3 additional days to post funds. Also keep in mind that transfers that are scheduled on weekends or holidays won’t be accepted by your bank until the next business day. Also some US and Australia customers may initially be set for a seven day transfer while business activity is evaluated.

Q: Why does the date listed on the Deposit/Transfer report not match the date of the actual deposit into my bank?A: The Date identified as the Deposit/Transfer date is the intended/scheduled deposit date indicated by Stripe. The actual deposit date could possibly be delayed most commonly because most banks do not process transfers on weekends

Q: Do all credit card transactions carry over to the Journal Entry Export report?A: No. Payments, Receipts and Refunds (negative Sales Receipts) that are automatically created by the software will be included in the JEE. However, you will need to make a manual adjustment in your accounting software to record processing fees, dispute fees, or charge backs, as those will not be deducted from the journal entries. Use your Bank Account Deposits/Transfers report to find the totals of each deposit for what will need to be adjusted.

For QuickBooks users using the detail journal entry export option, it is recommended that deposits are handled within QuickBooks. Be sure to select the ‘Exclude Deposits’ option at the time of export. When the deposit is recorded in QuickBooks a line item can be added to account for the total amount of the fees that were withheld from each transaction resulting in a net deposit that will match bank statement activity. View detailed steps.

Q: How do you recommend I record my transaction fees so that my deposits match what is actually being deposited?A: Include the transaction fee amount, which is shown on the Bank Account Deposits/Transfers report, as part of your deposit in your accounting software. View detailed steps for those using the detail Journal Entry Export with QuickBooks desktop.

Q: We want our members to pay off their annual dues by paying 3 equal payments in 3 consecutive months. Can we automatically charge a card consecutive months in a row and then stop charges for the remainder of that year?A: Yes this can be setup to accommodate any number of consecutive equal payments. How? Assign a monthly epayment fee item to this member and set the Status to Active in Date Range. http://screencast.com/t/j99nKmunRk The Start Date should be the 1st month that you want payment to be charged and the Expiration to the month of the last payment (inclusive). The amount charged per month will be the Fee Amount / 12 so you will need to inflate the Fee Amount assigned so that when it divides by 12 it will be what you want to charge monthly. The example shown here would charge $400 in April, May and June totaling a $1200 annual fee but requires putting $4800 in the Fee field. (Note: the Fee field is not visible to members or in your accounting totals)

Q: Can we set our epayments to charge on a particular day of the month?A: No, not exactly. ePayment charges happen on whatever day you login to the software and click to Save the batch.

Q: Can I charge certain members on the 1st and others on the 15th?A: Yes if setup properly. Create another duplicate fee item(s) for the 15th of the month. When creating the fee you would create/assign a new Batch Invoice Group e.g. ePayment 15th Batch as shown in this example. http://screencast.com/t/fiBqqk5TqLqS Any members that must be charged on the 15th should be assigned this new fee item. By specifying that this fee belongs to an invoice group other than the default, you now will be able to bill these members in a separate batch. When you need to create your invoices on the 15th, make sure to select the ePayment 15th Batch as your Invoice Group when clicking Invoices from the Task List. http://screencast.com/t/0gekwey6MXh You can also select the correct Invoice Group when on the Invoices tab. http://screencast.com/t/SCA6o6gxm

Q: Why are so many of my members' cards being declined?A: One reason, besides the normal variety of reasons that charges are typically declined, would be if you are trying to use the stored cards from your previous solution with Authorize.Net. Previously stored cards from another processor will not work with any other credit card processor. See the steps in Switching from Another Processor. http://supportwiki.micronetonline.com/Integrated_Payment_Processing#Switching_from_Another_Processor

Q: What if I already have automatic credit card processing with a 3rd party company but want to get setup with Integrated Payment Processing recurring charges?A: No problem. Follow the steps for Setup Recurring Charges but modify the initial message to indicate that you are changing your processor and need your member's help. In addition, follow these steps:

- If members were assigned a manual epayment fee when setup with your 3rd party company, switch it to the appropriate epayment selection once the member has entered the new epayment profile into the MIC. You can continue to run your epayment batch with a mix of manual and automatic epayment in the batch.

- If members were assigned an epayment fee with Authorize.net, those epayment profiles will no longer work and must be deleted prior to notifying the customers to add their new payment profile.

- If members were not assigned either a manual or epayment fee when setup with your 3rd party company, no additional steps are needed - - just assign the epayment fee once the member enters it into the MIC.

Member Use

Q: My member stored a bank account as one of their payment profiles in the Member Information Center but it says "Unverified" next to it. What does that mean?

A: The member’s bank account needs to be verified as being a valid bank account. To do that, the member needs to check their bank account for two small deposits that will have been made. Then they enter those amounts into their payment profile where indicated. The deposit items, labeled "MemberZone TRANSFER VERIFICATION", will typically show on the next business day after the account was created.

Q: My member has entered a payment profile for their bank account in the Member Information Center. Why doesn't it show as an option under "Charge to ACH, debit or credit card" when I go to assign and setup their recurring charges?A: The bank account will not show in the "Charge to ACH, debit or credit card" selection drop-down list until the account has been verified.

Q: Why was a member’s charge declined?A: Declines can happen for a variety of reasons. When we submit a charge to your customer’s bank, they have automated systems that determine whether or not to accept the charge. These systems take various signals into account, such as your customer’s spending habits, account balance, and card information like the expiration date and CVC.

Since these signals are constantly changing, a previously successful card might be declined in the future. Even if all of the card information is correct, and your customer previously had a successful payment, a future charge can still be declined by a bank’s overzealous fraud systems.

Q: How do I find out more information about a specific decline?A: If all of the card information seems correct, it is best to have your customer contact his or her bank, inquire for more information, and ask for future charges to be accepted.

Q: How do I decrease the likelihood of declines?A: The correctness of the card number, the expiration data, and the CVC are the primary factors used by the customer’s bank when deciding whether or not to accept a transaction. Collecting the CVC can significantly decrease your decline rates. If you’re not collecting CVCs and you’re having issues with declines, requiring the value can be a quick fix.

The influence of other data that you collect, like the address or name, varies by card brand. For example, only American Express consider the customer’s name. If you are still seeing troubles with declines after collecting the more influential fields, it might be worthwhile to collect this additional data.

Rates

Q: What are the rates?

A: Standard rates are:

- Pro edition – 2.99% plus 35 cents/transaction

- Premier edition – 3.25% plus 35 cents/transaction

- Plus edition – 3.49% plus 35 cents/transaction

- American Express all editions – 3.5% plus 35 cents/transaction

- No additional charges for setup, statements, transfers, batches

- No additional charges for convenient card and bank account storage using safe PCI-compliant methods

- No additional charges to setup recurring billing to cards/accounts – it’s included in the software

Q: Are there any other charges?A: A $15 charge would be incurred immediately for any charges reported as Fraudulent. If the dispute is won, the $15 will be credited back to your account. $1 charge / transaction occurs for automatic bank draft failures. Since bank accounts are verified when setup, the failure rate should be minimal and typically only in cases where the account is closed or has insufficient funds.

Disputed Charges

Q: What happens if a charge is disputed?

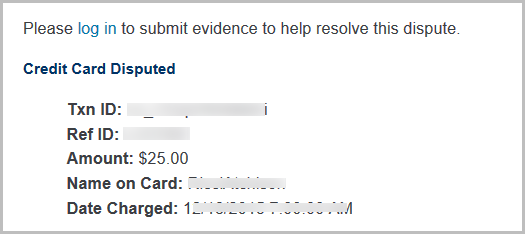

A: An email notification is sent to the address listed in the Payment Processing Reports / Management Tools that indicates the details of the dispute and gives direction on what to resolve the dispute.

Q: What information does a sample dispute email notification include?

A:

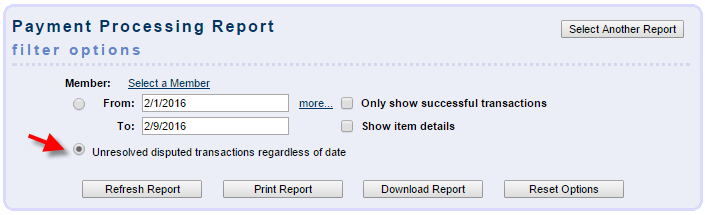

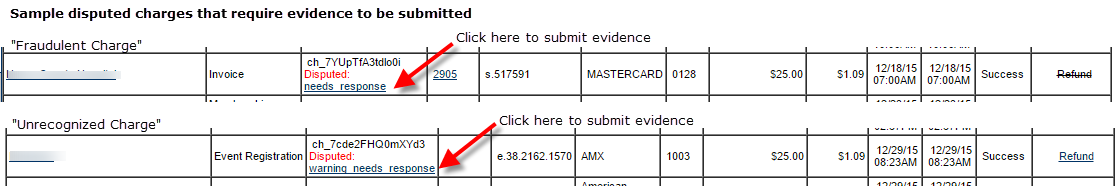

Q: Where do I enter dispute information?A: Follow these steps:

- 1. Access the Payment Processing Report under Billing ➝ Reports tab.

- 2. Select the filter “Unresolved disputed transactions regardless of date”.

- 3. Click Refresh Report.

- 4. Click the link next to the disputed charge.

- 5. Follow the instructions on the next screen. Entering as much evidence as possible prior to the date listed on this screen.

- 6. Once evidence is submitted, the link next to the charge will change to “under_review” while it is being reviewed. During this time, you may re-submit evidence up to 4 times before the indicated deadline. Allow 60-75 days for the review to be completed.

- 7. When the review is completed, the status will change to “won” or “lost”.

Q: How long does the dispute process take?A: Dispute resolution can take a long time, and we know that’s frustrating. During a dispute, banking entities engage in a series of formal communications that are a rigid part of the process, and we really can’t affect the timeline set in place by the banks and card networks. You can expect a dispute to be finalized approximately 60 days from the date evidence was due (not the date you provided evidence). If it has been more than 60 days since the bank’s evidence deadline, feel free to reach out to us and we’ll be happy to take a closer look!

Q: What evidence do you suggest that I provide?A: The evidence you’ll want to submit will vary depending on the specific case. Web logs, customer service emails, shipment tracking numbers and delivery confirmation, proof of prior refunds or replacement shipments, and so on, can all be helpful. You’ll want to provide evidence appropriate to the type of dispute—we offer suggestions here. Stripe will submit any information you can provide to your customer’s credit card company, and keep you posted afterwards.

Note that it is safe to assume that requests to call a contact number, click through to further information, and so on, will not be fulfilled by the institution that is evaluating the dispute. Banks will not follow external links to view your website or files you’ve uploaded elsewhere, so it’s important to include all evidence at your disposal in your initial evidence submission.

It is extremely important to provide evidence for every dispute you hope to win, even if the cardholder/customer has told you they will withdraw the dispute.

Q: What happens when a charge is reported as a “Fraudulent Charge”?A: The disputed amount and the fee is deducted from your account the day after a dispute is received. The disputed amount and fee is refunded to your bank account if the dispute is resolved in your favor. This is referred to as a chargeback. https://support.stripe.com/questions/what-is-the-difference-between-a-chargeback-and-an-inquiry-or-retrieval

Q: What happens when a charge is reported as an ‘Unrecognized Charge?”A: Basically, an “Unrecognized Charge” is an inquiry or retrieval request that asks for information about a transaction. These usually occur after a cardholder calls their issuing bank about a charge they don’t recognize or other discrepancy on their bill.

The disputed amount is not deducted from your account and no fee is charged.

If you choose to Refund the full amount, the dispute will automatically be resolved. However, if the charge is valid and you do not wish to refund, it is always recommended that you reach out to your customer first to get more information about the reason for the dispute.

If you reach an agreement with your customer, and they agree to withdraw the dispute, it’s still important to provide evidence (even if it’s simple text evidence indicating that you’ve communicated with them and they’ve agreed to withdraw).

Once you produce sufficient evidence to defend the transaction, this type of dispute can usually be settled in your favor. Many disputes are the result of the cardholder not recognizing the transaction, and providing basic info about your business and what was purchased is usually sufficient to close the case.

However, if the customer refutes your evidence, or the bank considers it insufficient, the bank might escalate the inquiry into a chargeback and begins the process of returning the customer’s funds—it’s important to resolve the case while it is still in this stage.

Q: What is the difference between an “Unrecognized Charge” and a “Fraudulent Charge”?A: Sometimes, a cardholder’s bank may initiate an investigation into a complaint before a formal chargeback. These investigations are displayed as “Unrecognized” charges, but they differ from those marked as “Fraudulent” or full chargebacks in two ways: No funds are moved during an inquiry/retrieval investigation (you retain the funds), and charges are refundable during the inquiry or retrieval investigation.

Q: The customer indicates that the dispute was a mistake. How do I get the dispute reversed?A: If you’ve talked to your customer and they’ve agreed to drop the dispute, there are a couple next steps. First, have your customer call their bank and let them know. This is critical, since the bank won’t know your customer has dropped it unless your customer tells them.

Secondly, even though the customer has already agreed to withdraw the dispute through their bank, you must still submit evidence for the dispute. Your evidence should indicate to the bank that your customer wishes to drop the dispute, and must include any email evidence you have where the customer may say that. If your customer had specific complaints that led to the dispute, be sure to address those in the evidence. Failing to provide evidence even though the customer agreed to drop the dispute could still result in you losing the dispute.

Once you’ve done those two things, we need to wait for the bank to let us know that the dispute has been closed in your favor. As soon as they do that, we will return the full amount of the charge and the associated fee to you. Do note that this process can take quite a while—it’s not unusual for us to not hear from the bank for 60-70 days after the dispute. As soon as we know that the dispute is closed in your favor we will send you an email.

Q: My customer withdrew their dispute so I could provide a refund but the Refund button is crossed-out and unavailable. What should I do?A: Often, customers don’t realize that the dispute process is not simply an “easy refund” - it penalizes merchants. Most merchants are more than happy to provide a regular refund if the customer asks them to. When a charge is disputed, and the customer is willing to withdraw the dispute so you can provide a normal refund, things can get rather complicated because the dispute process generally involves more than one banking entity handling the dispute.

Without intervention, the resolution process still takes approximately 60 days from the date evidence is due - and that’s a long wait for your customer, because you can’t process a refund until the dispute is resolved in your favor! There is a way to expedite the process, but it requires very specific evidence. When a cardholder withdraws a dispute, their bank will generally do two things: re-bill their card account for the disputed amount, and provide them with a formal letter/communication (it might be a paper letter, an email, or a document in their online account) indicating that the dispute case has been closed. If you are able to obtain a copy of this letter, or clear evidence of re-billing, you may reach out to us with this information and we may be able to close the dispute before the 60 day period ends.

Even in cases where your customer withdraws, submitting evidence is vitally important. You should respond just as you would if the customer was not intending to withdraw, but certainly mention their intention to do so and include any correspondence you have had with your customer that indicates they will withdraw the dispute with their bank. But do respond! Evidence submission is extremely important to the dispute process and a successful resolution in your favor.

Q: I lost a dispute, is there anything I can do?A: We know how frustrating it is to lose a dispute, and we’re sorry to say that once a dispute has been lost, that outcome is final.

Disputes are decided by the cardholder’s bank, according to the bank’s process. The steps Stripe follows to help you respond to the dispute and submit evidence are rigidly defined, but the decision made by the bank can be affected by a number of factors, such as the cardholder’s specific complaint, the strength of your evidence, and the specific details of the charge. Often the decision on who wins a dispute comes down to a judgement call by the bank. Stripe has no way to affect this judgement call beyond submitting evidence on your behalf.

For this reason, it’s always best to take measures to avoid disputes. And when facing a dispute, it often helps to work with the cardholder (where possible) to withdraw the dispute.

Mobile Card Reader Connection

Q: Is there a specific mobile card reader that I need to use?

A: Yes. Our software must use a specific mobile card reader called the Shuttle, by ID TECH. The UniMagPro may also be used but we’ve determined that the Shuttle has a design that keeps the reader steady while swiping. The Shuttle also supports a larger numbers of Android devices.

Q: Does it matter where I purchase the Shuttle?A: Not exactly. But we have a relationship with a distributor that will provide our customers a special 5% discount and free shipping if ordering using a special promo code. Contact customer support for the current promo code. Order the Shuttle online with IDScan.Net and enter the currently provided promo code.

Q: Once ordered, how long does it take for the Shuttle to arrive?A: If ordered from our partnering distributor, IDScan.net, US order will arrive between 5-7 business days. Orders placed before 3:00 p.m. CT should be shipped that same day. International orders would be a few days longer.

Q: What tips do you have on using the Shuttle mobile card reader?A: You may need to remove the protective case on your Android or iOS device in order to make a good connection with the Shuttle. Check the Card Reader Status entry under Settings on the staff app to see if your card reader is being recognized.

Remember that your Android or iOS device can be placed in auto-rotation mode or have auto-screen rotation mode turned off. Choose the selection that works best for you and how you are using your device.

Q: What Android or iOS devices are supported with the mobile card reader?A: All iOS devices are supported.

The supported Android devices are listed here and updated several times a year. The supported device list is quite specific and we have found it to be correct down to the Carrier specified and Operating System. Also note that you can still process credit cards manually in the app even with no device present.

Q: My Android device is not on the list of supported devices, can I still process credit cards from the app?A: Yes. The manual entry selection will work to process the transactions regardless of whether the mobile card reader is connected.

Q: What if the credit card is damaged and a successful swipe can’t be made?A: No problem. There is always an option to enter the card manually – typing in the customer name, credit card number and expiration date. This option is available regardless of whether the card reader is connected.

Q: Will my phone still work when I have the card reader plugged in?A: Yes – your phone will still work and an incoming call can be received, but because the card reader is plugged into the audio port, you will need to unplug the reader in order to successfully hear and speak to the incoming caller.

Q: How long can I expect a single transaction to take to process the credit card?A: On a Wifi network that was tested at approximately 5 Mbps for download and 2.5 Mbps upload speeds (speeds often at the low end of 4G LTE networks), we found the transaction completed in less than 10 seconds from the moment that Submit Payment is clicked until the attendee list refreshes with the attendee marked as paid.

On the contrary, with a download speed closer to .50 Mbps download and upload speed (more typical of slower 3G networks) the complete transaction back to a refreshed attendee list will typically take approximately 30 seconds. No manual interaction is needed for those 30 seconds as the screen will move from one stage to the next about every 5-10 seconds, providing on-screen messages that processing or refreshing is taking place.Feel free to download a free app titled “Speedtest.net” to test your device prior to your event to determine what speed you might expect.

Q: Can you explain the differences between 3g and 4G, and 4G LTE?A: There is not an exact definition because various providers have their own version of what these networks speeds mean but we found this article helpful to get the big picture. In the end, the speed of your network is what is important, not what it is called.

Feel free to download a free app titled “Speedtest.net” to test your device to see where your devices fits in the speed spectrum.

Q: Does your device support EMV?A: Our initial entry into the card reader solution is a simple swipe device and does not yet support the EMV chip reading or Apple Pay. This gets us into the arena with a path to change to different devices as we continue moving into mobile card reading. We definitely have that on our radar, but the certification required to work with the EMV devices is very time-intensive and quite involved which has been part of the reason for the slower adoption rate in the US.

Per the article on bankrate.com by Jen A. Miller, “Why you’re still swiping - - not dipping - - your credit card” it is mentioned that Bastian Knoppers, senior vice president of retail payments for banking and payments technology firm FIS Global, says the shift will continue for some time. "We look at other countries, typically EMV migration is anywhere from 3 to 7 years," he says. "In the U.S. right now, we just finished year 1. We're entering year 2." And even then, some retailers will never install chip-reader terminals as has been the experience in other countries that have adopted EMV, Knoppers says.

Q: Can I use the mobile card reader if I use another credit card solution like Authorize.Net, Beanstream, Heartland or PayPal?A: No, at this time only our Integrated Payment Processing is supported. But using our Integrated Payment Processing may save you time and money with all the benefits and integrated features that we offer. View more information on what our solution can provide: MemberZone / ChamberMaster

Mobile Card Reader App Usage

Q: What is the best way to be prepared at my event for processing attendees the quickest?

A: When possible, attendees should register and pay ahead of time using your online registration.

Second best is if the attendee can be registered with the correct total listed as due. Do not invoice them ahead of time, instead leave them set on the Invoice or Cash selection for payment method (either is fine).

At the event these unpaid attendees will display with a Payment icon next to their name. Tap the icon and you will automatically be presented with an option to swipe the card or enter manually. After the payment has been submitted, an automatic invoice and payment or sales receipt will be created according to your settings under Events->Fees tab in the Registration and Billing Preferences section.

Q: If pre-registration and pre-payment is not possible, you can add a walk-up attendee.

A: See the next FAQ.

Q: How do I add a walk-up attendee that is not on my Guest List?

A: While viewing the Attendee List In the app, click the + button in the upper right corner of the screen which will open event registration in your mobile browser. Complete the event registration making sure to select Invoice (or Cash) for the payment method on the registration if you want to use the card reader for credit card payment. Then switch back to the App window. Refresh your guest list if needed. Then click the payment icon next to your newly registered attendee.

Q: Is there a receipt that is emailed to the registrant that pays by credit card?

A: Yes. The email address from the Primary Contact on the registration will default as the email address to receive the payment confirmation email but may be changed to any email that you enter immediately before clicking Submit Payment Now in the app. They receive the same Payment Confirmation email that comes when other credit card payments are made.

Q: Can I pay a partial amount on a registration?

A: No. On the app, you must pay for the whole registration amount. There is not an option to enter a different amount when accepting the payment. You can, however, enter comments in the Comment fields as to any changes that would viewed by the staff in the back office later. You would need to login to the back office and make any modifications to the event registration and then refresh the app screen.

Q: If two or more are registered together on one registration, can I pay for just one attendee?

A: No. On the app, you must pay for the whole registration amount. There is not an option to enter a different amount when accepting the payment You can, however, enter comments in the Comment fields as to any changes that would viewed by the staff in the back office later. You would need to login to the back office and make any modifications to the event registration and then refresh the app screen.

Q: How is the Reference # field used on the App?

A: If you enter something in the Ref # field, prior to the swipe, it will be appended to the successful Ref # that is added automatically. This appears on the payment in the back office in the Ref # field.

Q: Why is the "Pay with Card" button missing from the Payment screen on certain attendees?

A: If the payment icon is available, but the Pay with Card button does not appear it means that the attendee has already been invoiced. At this time only those who have not been invoiced or had a receipt created can be paid for with the Pay with Card button. Note: You can pay invoices that have previously been created by logging into the Member Center as this member or from your back office software where you can manually enter their card information.

Q: Why don’t I see the Pay with Card button on my payment screen for the registration and I have an invoice already created for the registration?

A: When an invoice has already been created, accepting a payment from the app does not currently have the ability to match the payment against that invoice. In order to eliminate duplicate invoices or an unneeded sales receipt, we are presently not allowing card swipe against Invoices that have already been created. If the invoice was not yet created, card swipe would be allowed because the app would make the invoice and payment for you when it saves the payment. Note: You can pay invoices that have previously been created by logging into the Member Center as this member or from your back office software where you can manually enter their card information.

- ↑ The checking or savings account must be set up as a Payment Profile and they verified before it can be used as a payment option.